Businesses around the world continue to experience an ongoing impact of the COVID-19 pandemic in a realm of areas, including socially, emotionally, and financially. Have you felt as though you’re on the brink of financial disaster this past year?

Positive financial habits are often hard to make and easy to break. However, we encourage you to take the time to read through and build the following five habits into your life:

- Always spend within your means.

There is a popular idiom that says "cut your coat according to your cloth". Instead of envying what another has, learn to understand where your resources lie and how to spend within what you can afford. Which means that many times, you will have to say no to yourself so that you can build a stronger and better future. - Don’t over-borrow.

Over-borrowing is extremely tempting given the zero-interest rate offers that are going around. Although it appears that there is no catch, for most financial houses offering "zero interest", there is often an account management fee attached on a monthly basis. So don't get trapped!

So what are some risks involved when you over-borrow?

- you pay higher interests

- repayments can take longer

- you start getting yourself into bad financial habits borrowing from one institution to cover off the loan of another

- missed payments will have consequences and in life, emergencies do occur

- you may have to start purchasing your dream home or start a family later than you would like as your borrowing capacity is reduced - Protect income and assets

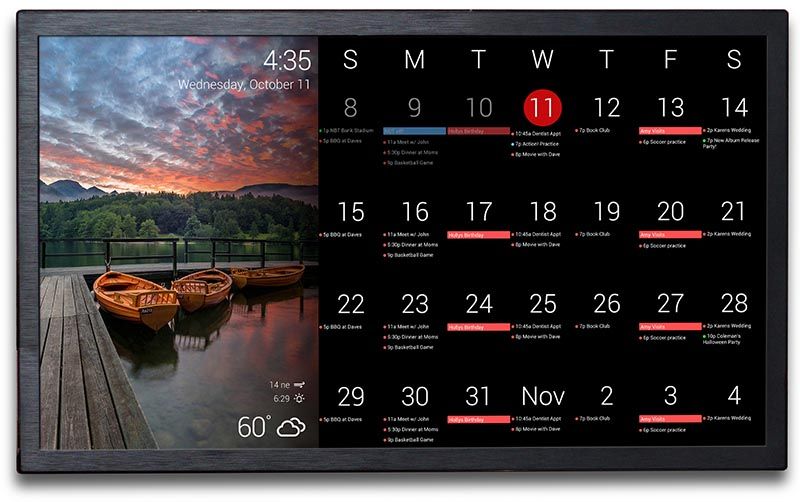

While we are usually quick to insure our physical assets such as our home, contents and vehicles, consider our greatest asset of all - our ability to earn an income. It is important to ensure that our families are protected on a rainy day. Another investment worthwhile evaluating is the building your skills as a form of insurance. Not only will it make you a more valuable candidate, in case of a redundancy or in search for a new job, it will give you more career options down the track. - Check income, expenditure, and debt every six months + personal insurance each year.

Make sure that you put this into your calendar. We often get so carried away with our daily demands that we easily skip checking our finances on a regular basis. Is your coverage reflective of your current business, family and personal situation? - Get Personal Finance Advice.

Professionals are paid for a reason. If you want to put your finances in order and desire to intentionally and purposefully grow your wealth, speak to the professionals who can help you do just that.

We recommend dedicating one day every month to evaluate your progress in these five areas and review your current financial situation. This provides an opportunity to reflect on your earning, spending, and progress towards the development of these as habits. We love the ease of allocating the day in our digital calendar with a reminder alert, but a hard-copy calendar will do the job just as well!