After hearing weeks of rumours surrounding superannuation concessions, the change has been announced. The Australian Treasurer and Prime Minister have confirmed that as of July 1st, 2025, following the next federal election, super balances valued at over $3,000,000 will be subject to an additional 15% tax, leading to a combined headline rate of 30%.

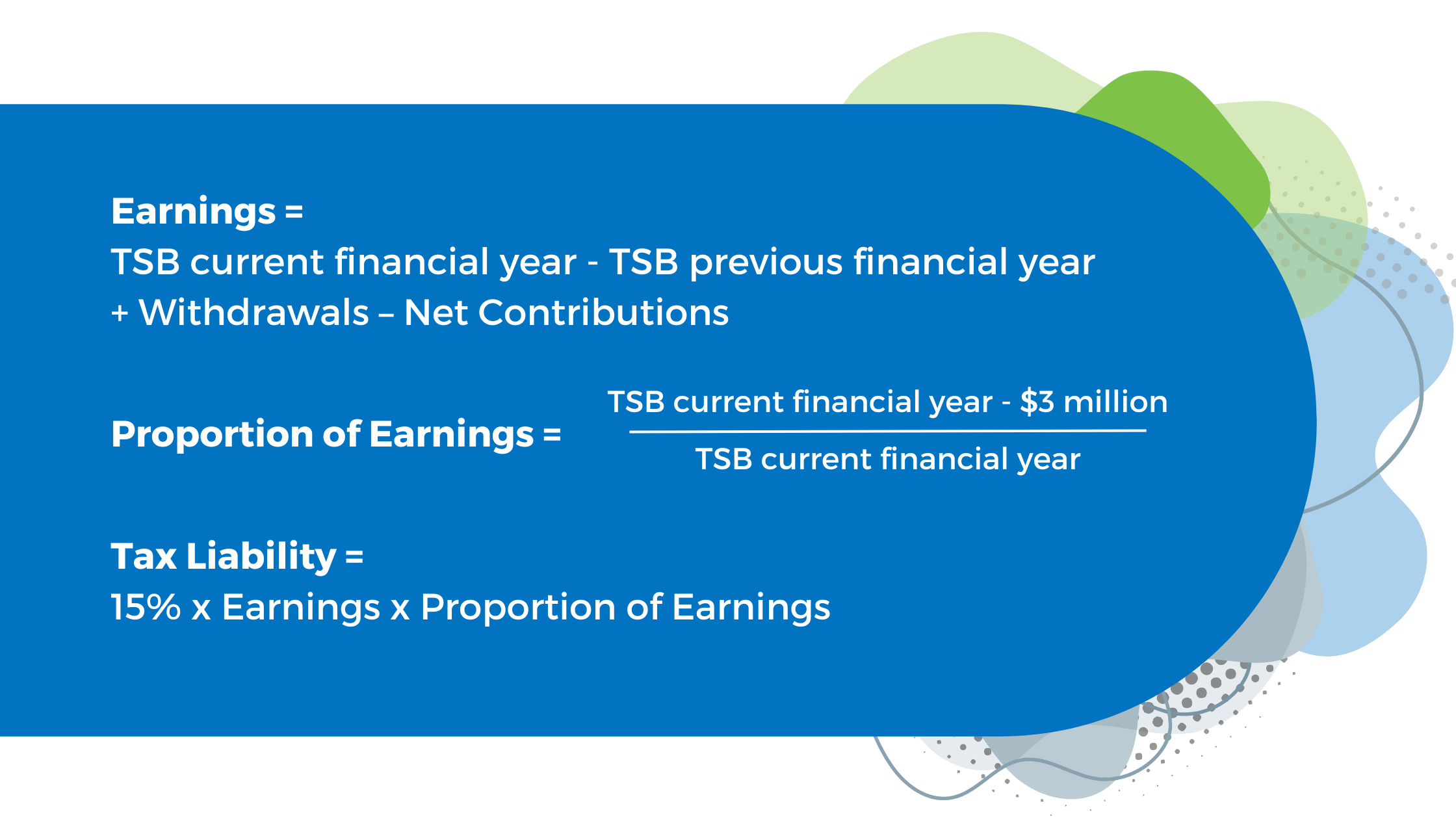

This additional taxation applies only to the proportion of earnings over the $3,000,000 threshold, while the funds below this will continue to be taxed as normal (at 15% or less). The Superannuation Legislation defines “Earnings” as the difference between the Total Superannuation Balance at the start and end of the financial year, including withdrawals and contributions.

With regards to the payment of this tax, individuals can either pay through their superannuation fund or out-of-pocket, and this tax is separate to the standard personal income tax. If an individual has multiple superannuation funds, they are permitted to elect the fund from which the tax is paid.

You may use the formulas below to calculate the tax liability for superannuation holders so that you can see how much you will personally owe:

Prime Minister Anthony Albanese has said the reason for this change is that it would “strengthen the system by making it more sustainable,” as “the savings that are made from this… will contribute $900 million to the bottom line of the forward estimates and some $2 billion when it is operating over the full year period.” He further claims that the fundamentals of the superannuation system will be unchanged as only less than 80,000 people are projected to be affected by 2025-2026.

Treasurer Jim Chalmers outlined that the current labour government has inherited $1 trillion in debt, as well as growing spending pressures in defence, health, aged care, and NDIS. To combat this, he goes on to say that “We need to make responsible budget choices to ensure generous superannuation tax breaks are better targeted and sustainable.”

While the reform has been confirmed, it will not be implemented until legislation is passed as well as consultation with major superannuation industry bodies.

If you have a superannuation fund and are concerned on how this change will impact your specific circumstances, please contact us, so that we can review you situation and advise you of any necessary changes.

.png)