The economic impact due to the Covid-19 seems to be hitting Australians hard. The Federal and State governments are trying relentless to keep the economy from sliding. Watch video from Dinesh Aggarwal here.

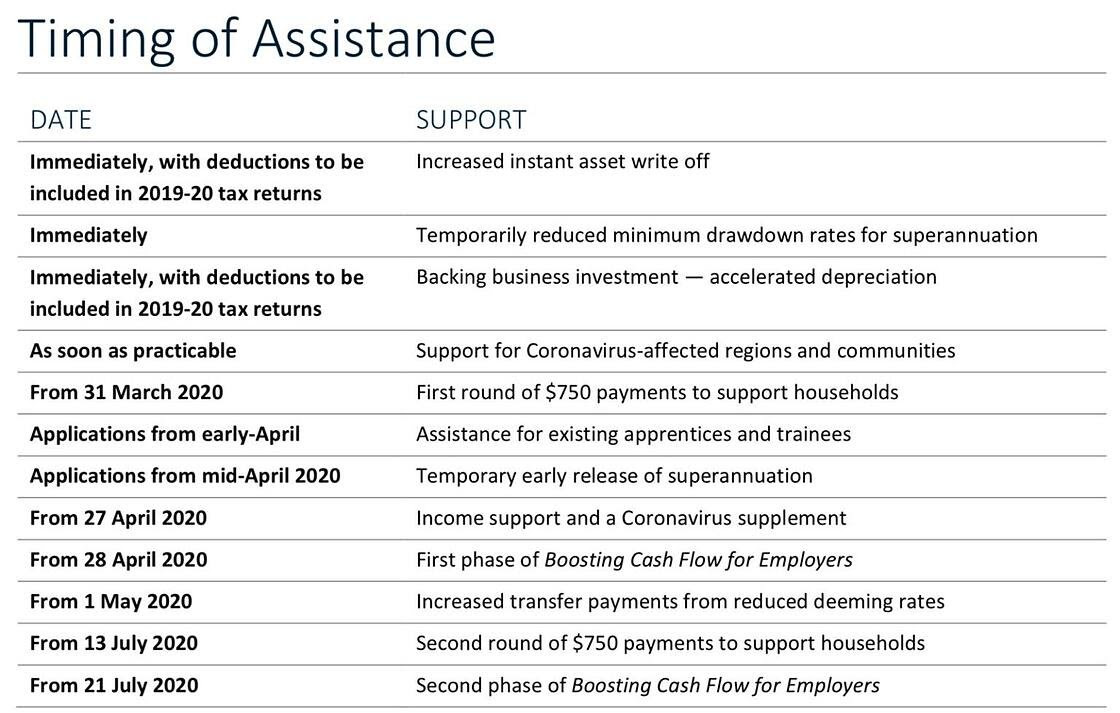

In addition to the federal government’s stimulus package of $17.6 billion last week which we have published a fact sheet for you to download earlier, there are other strong stimulus measures that have come through since. Below is a snippet of what the stimulus packages are:

Federal Government’s second stimulus package - $66 billion (22nd March)

The Treasurer has announced its second Economic stimulus package (22 March 2020).

The key business tax measures include modified cash flow assistance for employers. Key points:

- The previously announced tax-free payment of $25,000 for employers under $50m turnover (based on prior year) will be increased to $50,000.

- The minimum payment will be increased from $2,000 to $10,000 and will include NFPs.

- The payment will be based on 100% (instead of 50%) of the PAYGW amount reported in the activity statement from January to June 2020.

- An additional payment equal to this amount will also be available from July to October 2020, taking the total available payments to $100,000 (minimum $20,000).

- The payments will be automatically credited by the ATO through the activity statement system.

- The payments will only be available to active eligible employers (other than charities) established prior to 12 March 2020.

There is no change to the other measures previously announced on 12 March:

- Increased IAWO i.e. increased asset threshold of $150,000 and turnover threshold of $500m until 30 June 2020;

- Limited 50% depreciation incentive until 30 June 2021;

- 50% wages subsidy for apprentices and trainees until 30 September 2020.

In addition, the government has also announced a new ‘Coronavirus SME guarantee scheme’ which will support lending to SMEs worth $40 billion. It will be available to all businesses with a turnover of less than $50m.

Under the proposal, the commonwealth will guarantee 50% of an eligible loan through participating banks and non-bank lenders to businesses disrupted by the Coronavirus. Loans will be used for working capital purposes and be unsecured and it will be for loans granted within six months starting 1 April 2020.

Lenders will not be charged a fee for accessing the guarantee scheme. Loans will be repayment-free for six months. The maximum that can be borrowed under the guarantee facility will be $250,000 on terms up to three years.

ATO’s Support measures to assist those affected by Covid-19

Options available to assist businesses impacted by COVID-19 include:

- Deferring by up to six months the payment date of amounts due through the business activity statement (including PAYG instalments), income tax assessments, fringe benefits tax assessments and excise

- Allow businesses on a quarterly reporting cycle to opt into monthly GST reporting in order to get quicker access to GST refunds they may be entitled to

- Allowing businesses to vary Pay As You Go (PAYG) instalment amounts to zero for the March 2020 quarter. Businesses that vary their PAYG instalment to zero can also claim a refund for any instalments made for the September 2019 and December 2019 quarters

- Remitting any interest and penalties, incurred on or after 23 January 2020, that have been applied to tax liabilities

Working with affected businesses to help them pay their existing and ongoing tax liabilities by allowing them to enter into low interest payment plans.

WA Government stimulus

The WA State Government also announced a $607 million stimulus package to support WA households, pensioners and small businesses in the wake of COVID-19. The package includes:

- a freeze will be placed on household fees and charges, including electricity, water, motor vehicle charges, the emergency services levy and public transport fares.

- an allocation of $402 million in the 2020-21 Budget will go towards paying for the freeze.

- $91 million allocated to double the Energy Assistance Package (EAP) in 2020-21 to provide additional support to vulnerable Western Australians. The payment will increase from $300 to $600 for eligible concession cardholders.

- $114 million in measures to support Western Australian small and medium businesses.

- payroll tax paying businesses with a payroll between $1 million and $4 million will receive a one-off grant of $17,500

- $1 million payroll tax threshold brought forward by six months to July 1, 2020

- small and medium sized businesses affected by COVID-19 can now apply to defer payment of their 2019-20 payroll tax until July 21, 2020